Sephora vs Ulta Beauty Data Analysis 2025 | Actowiz Solutions

Introduction: Why Sephora vs Ulta Beauty Is a Data Problem

Sephora and Ulta Beauty are not just retail competitors. They represent two fundamentally different strategies in modern beauty commerce—one focused on premium brand authority, the other on accessibility and assortment breadth.

In 2025, competitive advantage in beauty retail is no longer driven by brand storytelling alone. It is driven by data visibility across physical stores, digital shelves, pricing behavior, and consumer engagement signals.

This technical blog by Actowiz Solutions breaks down the Sephora vs Ulta Beauty rivalry using structured retail, e-commerce, and digital data, showing how large-scale data extraction and normalization reveal strategic advantages that are invisible at surface level.

Methodology: How This Analysis Was Built

Unlike opinion-based comparisons, this analysis is grounded in multi-source data extraction, including:

- Retail store location data

- E-commerce product listings from Amazon & Walmart

- Pricing and review signals

- Digital engagement indicators

- Platform-level assortment depth

Actowiz Solutions uses automated web scraping pipelines, location intelligence datasets, and structured data engineering to normalize this information into comparable metrics.

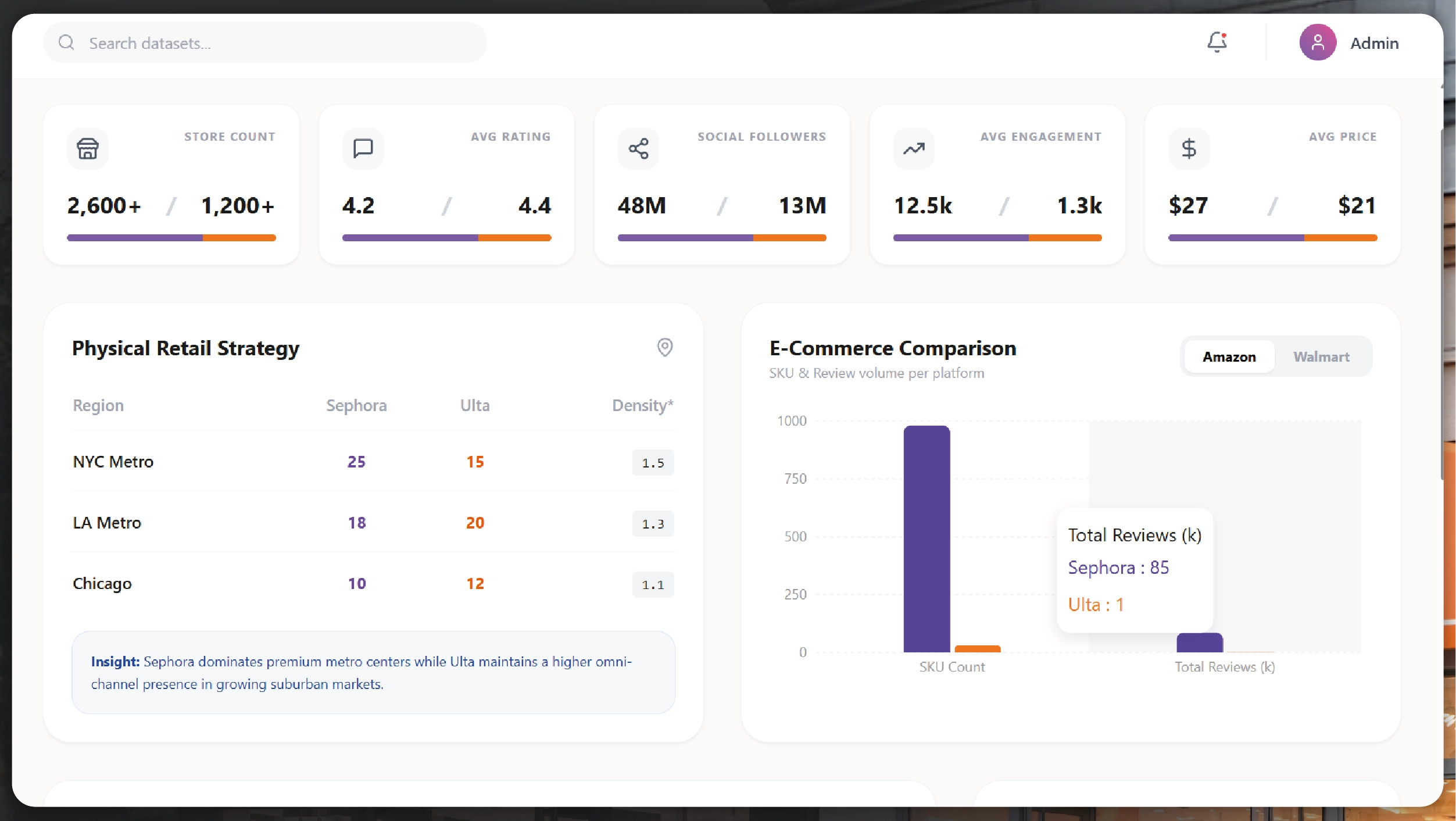

Physical Retail Strategy: Store Presence Where Spending Power Lives

Why Store Location Data Still Matters

Even in a digital-first world, beauty retail remains deeply physical. High-income zip codes drive:

- Higher basket sizes

- Premium brand adoption

- Repeat loyalty

Using store-level POI (Point of Interest) data, Actowiz mapped Sephora and Ulta Beauty locations against high-GDP and high-income regions in the United States.

Key Observations

- Sephora shows a concentrated footprint in affluent metro regions, aligning closely with premium consumption patterns.

- Ulta Beauty has wider national coverage, but a comparatively lower density in ultra-high-income urban clusters.

- In select high-value regions, Sephora’s store density per capita is significantly higher.

This suggests Sephora’s physical retail strategy is selective and margin-focused, while Ulta prioritizes volume and accessibility.

E-Commerce Scale: Measuring Digital Shelf Power

Why Digital Shelf Size Is a Leading Indicator

On marketplaces like Amazon and Walmart, brand success is often correlated with:

- Number of SKUs listed

- Review velocity

- Visibility across search and category pages

Actowiz Solutions extracted product-level listing data to evaluate digital shelf presence.

Sample Digital Shelf Comparison (Illustrative Data)

| Platform | Brand | Product Count | Total Reviews | Avg Rating |

|---|---|---|---|---|

Technical Insight

- Sephora’s SKU dominance on Amazon creates a compounding advantage: more products → more reviews → higher algorithmic visibility.

- Ulta Beauty’s limited Amazon assortment indicates controlled channel exposure rather than aggressive marketplace expansion.

- Walmart emerges as a low-engagement channel for both brands, signaling platform-audience mismatch.

Pricing Intelligence: Premium vs Accessible Economics

Average Online Pricing Behavior

Actowiz Solutions normalized pricing data across platforms to remove:

- Pack-size bias

- Duplicate listings

- Sponsored distortions

Sample Pricing Snapshot

| Platform | Brand | Avg Price (USD) |

|---|---|---|

What the Data Tells Us

- Sephora consistently sustains a price premium without a proportional drop in ratings.

- Ulta Beauty competes aggressively on price in mass channels but does not see equivalent engagement.

- Price elasticity favors Sephora in premium ecosystems, particularly Amazon.

This confirms a critical retail principle: brand equity reduces price sensitivity.

Digital Engagement as a Demand Signal

Beyond Followers: Measuring Engagement Quality

Raw follower counts are not enough. Actowiz Solutions focuses on:

- Engagement per post

- Interaction velocity

- Platform consistency

Social Engagement Snapshot

| Brand | Total Followers | Avg Engagement/Post |

|---|---|---|

Technical Interpretation

- Sephora’s engagement-to-follower ratio indicates high audience relevance, not just reach.

- Ulta Beauty’s posting frequency is higher, but engagement efficiency is lower.

- Engagement density correlates strongly with conversion readiness.

For data teams, this confirms that engagement quality is a stronger predictor of brand strength than audience size alone.

Review Intelligence: Trust at Scale

Why Review Volume Matters More Than Rating Alone

Actowiz Solutions evaluates:

- Review count

- Review velocity

- Rating consistency

A product with:

- 4.2 rating from 80,000 reviews is statistically more trustworthy than

- 4.5 rating from 500 reviews.

Sephora’s massive review footprint on Amazon indicates:

- Higher transaction volume

- Stronger post-purchase engagement

Ulta Beauty’s limited review presence suggests lower marketplace traction, not necessarily lower quality.

Data Engineering Behind the Analysis

This comparison required extracting and aligning data from:

- Store locator pages

- Marketplace product listings

- Review widgets

- Social platform metadata

Actowiz Technical Stack

- JavaScript rendering for dynamic content

- Pagination-aware crawlers

- Deduplication logic for multi-SKU products

- Schema normalization across platforms

- Structured outputs for analytics

Sample Unified Dataset (Illustrative)

| Brand | Channel | Metric | Value |

|---|---|---|---|

Strategic Takeaways for Beauty Brands

From a data perspective:

- Sephora wins on scale, engagement, and premium positioning

- Ulta Beauty wins on accessibility and physical reach

- Walmart is an underperforming channel for both

- Amazon is the clearest digital battleground

For beauty brands, this reinforces the need for platform-specific strategies, not one-size-fits-all distribution.

Why Actowiz Solutions for Competitive Retail Intelligence

Actowiz Solutions enables brands, investors, and analysts to:

- Track store expansion strategies

- Monitor digital shelf performance

- Analyze pricing and promotions

- Measure consumer sentiment at scale

- Build repeatable competitor intelligence systems

We don’t publish static reports. We build live, scalable data pipelines.

Conclusion

The Sephora vs Ulta Beauty rivalry is not about who is “better.” It is about who is optimized for which ecosystem.

Sephora dominates premium, engagement-driven channels.

Ulta Beauty thrives on reach and accessibility.

Only a data-first approach reveals these nuances.

With Actowiz Solutions, businesses can move beyond assumptions and build decisions on real, structured, continuously updated data.

📩 Email Us:

✉️ sales@actowizsolutions.com

📞 Call or WhatsApp:

📱 +1 (424) 377-7584

Source>> https://www.actowizsolutions.com/sephora-vs-ulta-beauty-data-driven-competitive-intelligence.php

Comments

Post a Comment